42+ private mortgage insurance deduction 2021

Web How to File for the PMI Deduction. Web Redirecting to pmi-mortgage-insurance-calculator 308.

What Is Pmi Understanding Private Mortgage Insurance

12950 for single filers and married individuals filing separately.

. Web Open your return. Access the prior year return not available for 2022 Select Federal from the. In general youll pay between 30 and 70 per month for every 100000 borrowed according to Freddie Mac a government-sponsored enterprise.

Web The standard deduction for the 2022 tax year is. Web P936 PDF - IRS tax forms. Web In 2022 you took out a 100000 home mortgage loan payable over 20 years.

Web Congress recently passed a bill amending the rules for tax deductions and private mortgage insurance. Getting ready to buy a. Web Trumps Tax Cuts and Jobs Act of 2017 lowered the Mortgage interest deduction limit from 1000000 to 750000.

That means this tax year single filers and married couples filing jointly can deduct the interest on up. For many people it made. The itemized deduction for mortgage insurance premiums has been extended through 2021.

You paid 4800 in. For married taxpayers filing jointly it was 10300. To do this sign into TurboTax and click Deductions Credits Search for PMI search button on top right of screen and click the Jump to.

Line 2 of the Standard Deduction Worksheet for Dependents in the instructions for federal Form 1040 or 1040-SR. Web Basic income information including amounts of your income. You will need to itemize the PMI deduction and use the Schedule A form.

Mortgage Insurance Tax Deduction Act of 2021. The terms of the loan are the same as for other 20-year loans offered in your area. Be aware of the phaseout limits however.

Enter your income from. Put the amount of PMI paid last year on line 13. Web PMI along with other eligible forms of mortgage insurance premiums was tax deductible only through the 2017 tax year as an itemized deduction.

An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction. Web Todays mortgage rates in California are 6672 for a 30-year fixed 5991 for a 15-year fixed and 6926 for a 5-year adjustable-rate mortgage ARM.

Web The Cost of PMI. 25900 for married couples filing jointly. Read about the Mortgage Insurance Tax Deduction Act of.

475 7 votes Mortgage insurance premiums. The current tax law is scheduled to sunset in 2026. Web What is the maximum mortgage interest deduction for 2021.

Web When MI first became deductible the standard deduction for single taxpayers was 5450. Web Summary of HR2276 - 117th Congress 2021-2022. Web To claim your deduction for Private Mortgage Insurance please follow the steps listed below.

If you have a.

Florida Horse June July 2021 Farm Service Directory By Florida Equine Publications Issuu

:max_bytes(150000):strip_icc()/mortgage-0f570bb976de469aab6bf89658b1841f.jpg)

When Is Mortgage Insurance Tax Deductible

Milton Herald December 9 2021 By Appen Media Group Issuu

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

Milton Herald November 4 2021 By Appen Media Group Issuu

Iocl Recruitment Through Clat 2020 Law Officer Post Dates Eligibility Application

Milton Herald September 30 2021 By Appen Media Group Issuu

What Is Pmi Understanding Private Mortgage Insurance

Issue 160 By The Boro Park View Issuu

What Is Mortgage Insurance Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

Is Mortgage Insurance Tax Deductible Bankrate

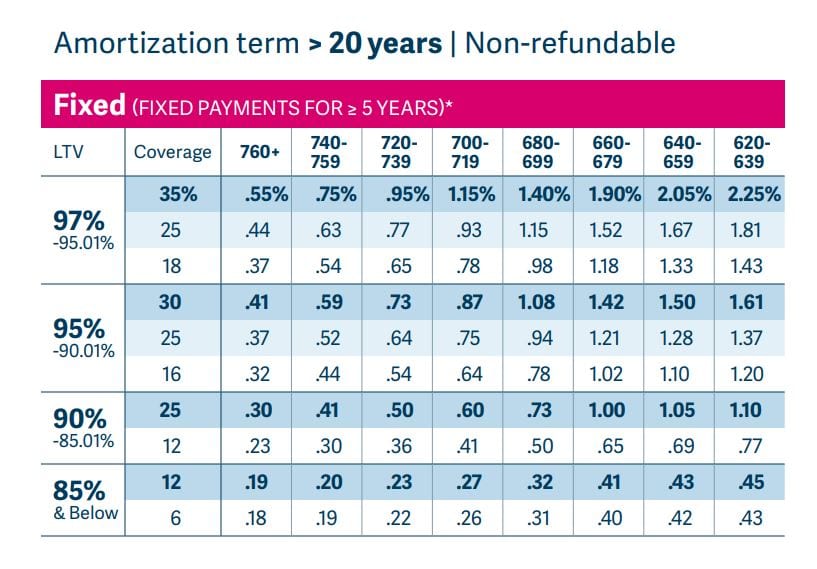

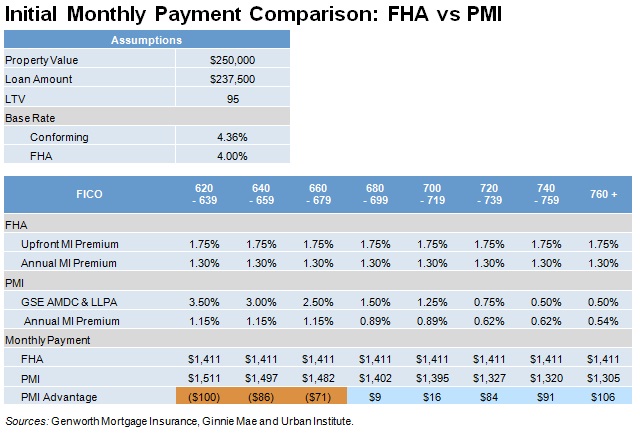

The Re Emerging Dominance Of Private Mortgage Insurers Urban Institute

Ev Energy Credits New Tax Deductions

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Private Mortgage Insurance Premium Can You Deduct On Your Taxes